Nanny and babysitting tax: what you should know

Have you ever wondered if babysitting is taxable? Do you know how to file taxes for nanny or babysitting income? Don’t worry, our tips will help highlight what you need to know about your nanny or babysitting income tax!

Do babysitters need to pay taxes?

It depends. Whether or not you need to pay taxes as a babysitter depends on your country, how much you work, how much you earn, and other factors about your working situation. So, it all depends on these factors about whether or not you are allowed to skip the taxes or get paid in cash.

When is it necessary for babysitters to pay taxes?

As a babysitter, you are generally paid a gross income by the family you are working for. Your ‘employer’ (the parent/family) often does not account for and pay taxes for you ahead of time, based on your earnings.

In this case, the babysitter does still have to check if they need to declare their earned income to the government tax authorities.

How much taxes do babysitters need to pay?

Depending on the number of hours you work and your work situation, you may not need to be officially ‘employed’ by the family you are working for. In this case, they don’t need to withhold taxes from your income. However, if they don’t withhold taxes and you earn above a certain threshold, you still need to declare this income when filling out your income tax and tax return.

Is babysitting working under the table?

Under the table workers generally are paid in cash, and this practice in many cases can be quite common when it comes to babysitting. The benefit? Neither the family nor the babysitter has to go through the extra work or earn less due to taxes.

Working under the table may look more beneficial or valuable, however, don’t forget that in many cases this can be illegal. If you earn large amounts of money and don’t pay taxes on this, this can be seen as fraud by the government.

So, the big question is: ‘is babysitting working under the table’? In short, the answer to this is no, however, you do need to follow a few rules in order to avoid it becoming working under the table. This can depend on what country you live in. Check below to see the regulations for your country.

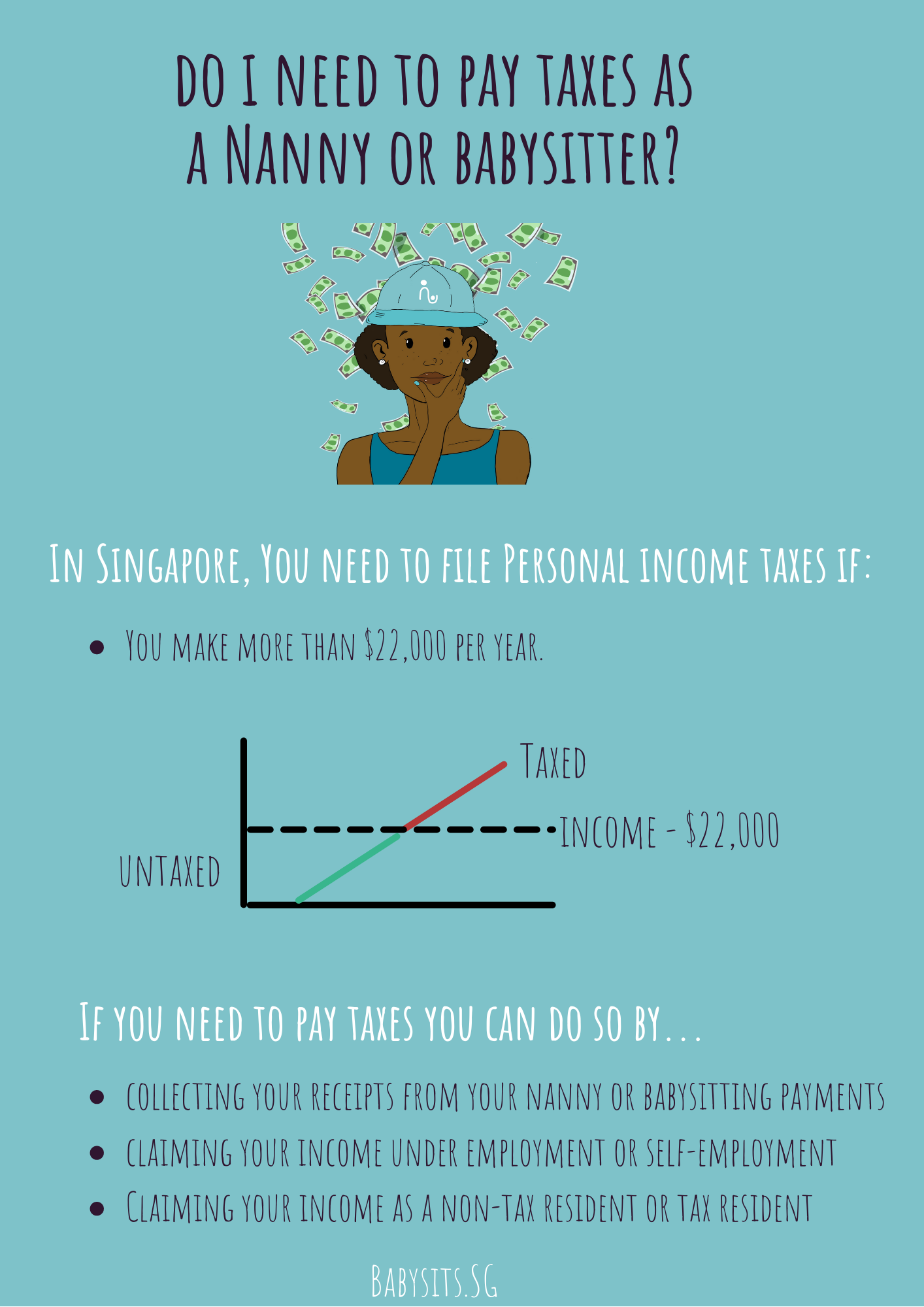

Babysitting and nanny taxes in Singapore

Personal income taxes in Singapore

Babysitters in Singapore most likely do not make enough income to have to file personal income taxes in Singapore. Most babysitters in Singapore are considered to be self-employed, because you would not normally work under a contract. If you are a nanny in Singapore, you are considered as an employee and often work under contract with a family. Singapore has a progressive taxation system. This means that if you make over 22,000 per year, it is mandatory that you file your taxes. Learn more about the basics of personal income taxes in Singapore with the IRAS.

How to declare your nanny or babysitting income

In Singapore, it is important when filing your personal income tax whether you are an employee or self-employed. You also need to determine whether you are considered as a non-tax resident or a tax-resident, as this determines your tax rate for the year. Tax-residents will be those who live and work in Singapore for more than 183 days of the year. Non tax residents will be taxed a flat rate of 15% and you must settle your taxes before leaving the country using this form submitted by your employer.

Now that you know how to handle your babysitting or nanny income tax in Singapore, it's time to get started! Find the perfect babysitting job or babysitter near you. We also have fantastic nannies at Babysits, so be sure to use our nanny search function to find nanny services today.